We have a diverse portfolio of assets with a capacity of over 2 6 gw making us the largest commercial solar investor in europe and a leading uk investor in onshore wind.

Octopus investments energy portfolio.

Peer to peer investments are not protected by the financial services compensation scheme.

Octopus renewables is one of the largest renewable energy investors in europe with over 3 billion energy assets under management at 31 march 2020.

We can map our investment profiles to the output of a selected risk profiling tool as well as provide suitability paragraphs to help with report writing.

Remember the value of an investment and any income derived from it can fall as well as rise.

Choosing a green supplier is all about being part of the movement towards an overall greener grid mix and so for all the energy we buy from the grid octopus renewables sends the same amount of renewables back to the grid and octopus energy adds extra investment in uk renewables through getting green power directly from community generators.

We work with wealth managers investors and institutions to invest money into areas that will help change our world for the better.

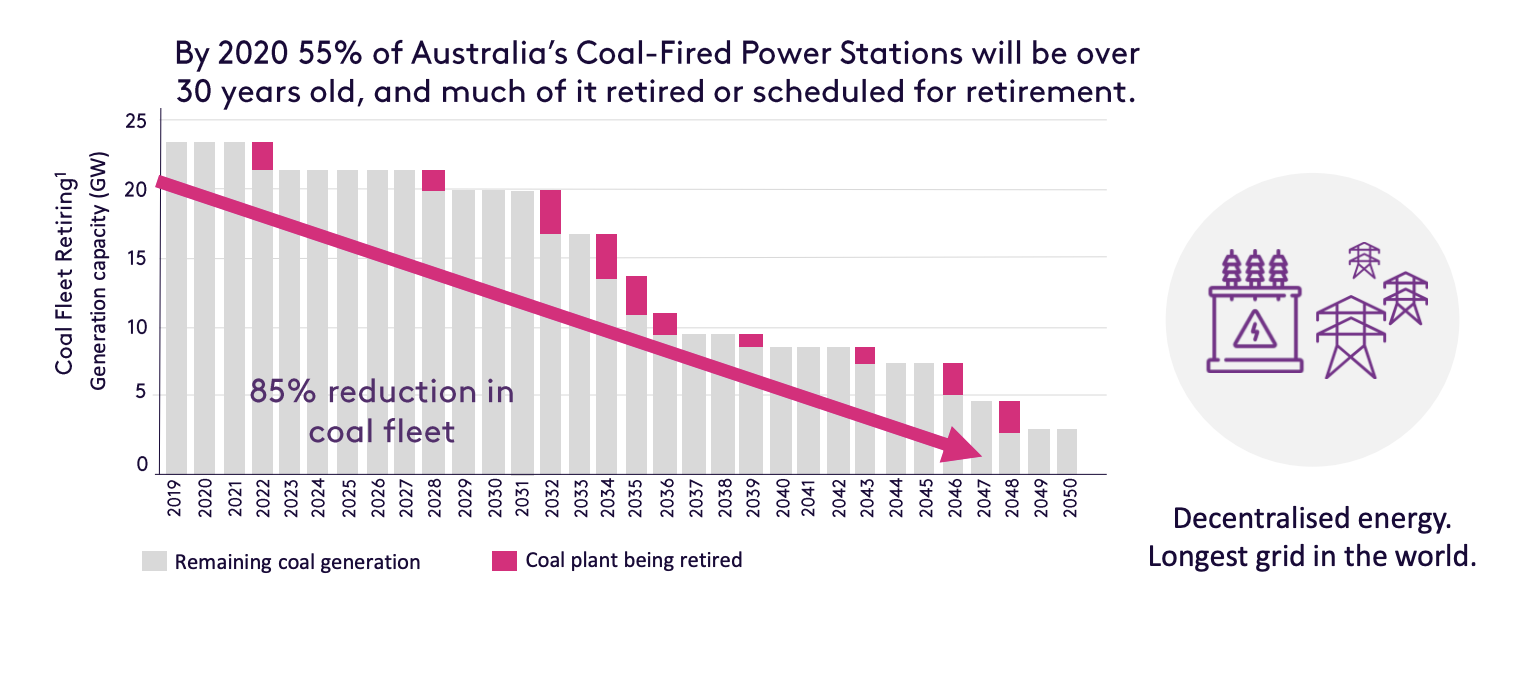

Octopus investments are investing directly into the australian renewable energy sector and helping to provide the innovative solutions it needs during its transition to a clean energy future.

We are seeking a portfolio manager to join the octopus renewables fund management and operations team.

Investment opportunities in wind and solar assets.

Our energy investment and asset management team of c 70 professionals is one of the largest and most experienced in europe.

At octopus we intend to be a leader in driving australia towards a cleaner future.

The companies in our portfolio are hiring view jobs.

Since entering the renewables market in 2010 octopus renewables has grown to become the largest investor of solar power in europe as well as growing to become a leading investor in onshore wind.

Octopus portfolio manager is available through a number of platforms and also off platform.

Investors may not get back the full amount they invest.

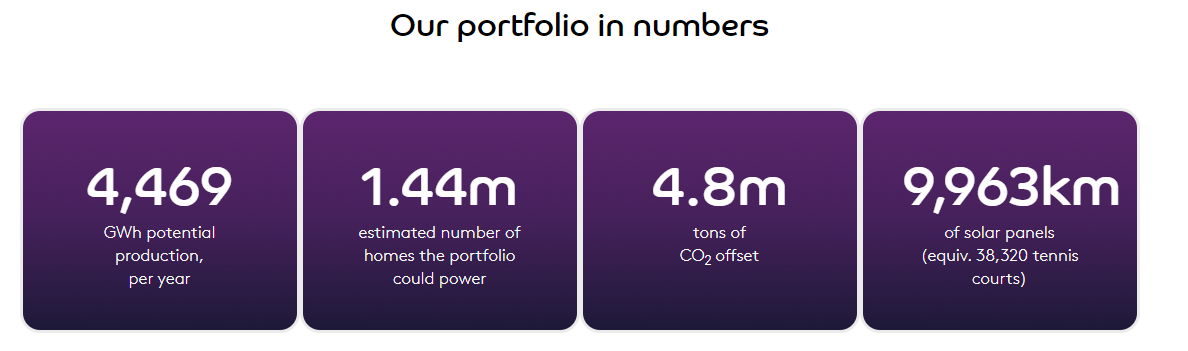

We currently manage a global portfolio of renewable energy assets valued at more than 3 billion.

Right now we re building a portfolio of renewable energy assets that will help australia lower its carbon emissions and meet its renewable energy targets.